Findings on copper price developments

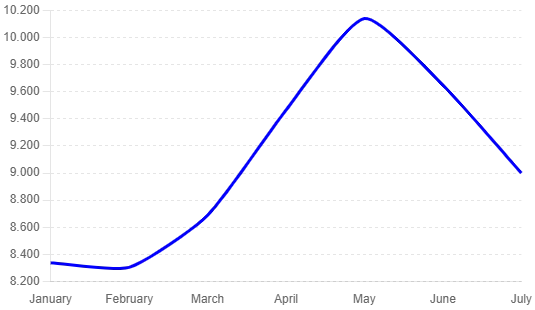

In 2024, the price of copper has experienced significant fluctuations. At the beginning of 2024, the price of copper rose, reaching a peak of $10,139 per ton in May, before falling to $9,648 per ton in June (YCharts), and even dropping to $9,000 USD at the time of writing this blog. This rise in price was driven by a combination of supply risks, declining stocks in LME warehouses, and hopes for a recovery in copper demand (MINING.COM).

Influential factors on copper prices

Copper is a crucial metal in the modern economy, used in everything from electric vehicles to renewable energy installations. The price of copper has changed significantly in 2024, influenced by various economic and geopolitical factors.

Risk Factors:

- Mine Closures

The closure of the Cobre Panama mine at the end of 2023 removed approximately 350,000 tons of copper from the annual global production. This, along with production issues at other major mines such as Anglo American’s Los Bronces mine, has impacted the price of copper (Nasdaq) (INN). - Weather Conditions

Extreme weather conditions, such as droughts in Zambia, have also delayed planned expansions in copper production (MINING.COM). - Geopolitical Tensions

The unrest in Ukraine and the Middle East creates an uncertain market and fluctuating demand for raw materials. - Production Reduction in China

A key cause of the recent price increase appears to be an agreement among major Chinese smelters to cut production.

Demand Factors:

- Energy Transition

The growing demand for copper for applications in the energy transition, such as electric vehicles (EVs) and renewable energy sources, continues to drive up the price of copper. Electric vehicles, for example, contain between 38.5 and 83 kilograms of copper per vehicle, and with the increase in the EV market, the demand for copper will significantly increase (Nasdaq). - Economic Developments

In addition to the energy transition, infrastructure development in countries like India also contributes to the rising demand for copper (MINING.COM). - Investment Climate

Political stability and favorable regulations in copper-producing countries are crucial for attracting investments in new mining projects. Instability in regions such as the Democratic Republic of Congo can further disrupt the supply (Nasdaq).

Copper Price Developments in the Last 6 Months

1. January 2024

The copper price began the year at $8,338 per ton. The market was relatively stable following the recovery period at the end of 2023. The main factor during this period was the tightening of supply due to mine closures and production restrictions at major mines (YCharts) (INN).

2. February 2024

In February, the copper price slightly rose to $8,305 per ton. This increase was partly caused by an increased demand for copper in energy transition sectors, such as electric vehicles and renewable energy sources (INN).

3. March 2024

March saw a significant increase in the copper price to $8,689 per ton. The main driver was the closure of the Cobre Panama mine and production reductions at other major mines, leading to a tighter supply market (INN) (ProcureChem).

4. April 2024

In April, the copper price continued to rise, reaching $9,464 per ton. This rise was driven by production constraints at Chinese smelters and an increasing demand for copper for industrial applications (ProcureChem).

5. May 2024

The price peaked in May at $10,139 per ton, the highest point in six months. This was largely due to ongoing supply issues and strong demand from the energy sectors. Geopolitical tensions in regions including Ukraine and the Middle East, as well as economic uncertainties, also played a role in the price increase (YCharts) (INN).

6. June 2024

In June, the copper price dropped to $9,648 per ton. This decline was caused by a slight decrease in demand and improved production conditions at some mines, although supply was still tight (YCharts).

7. July 2024

In July, the copper price has dropped to $9,000 per ton. This decline is partly caused by worsened economic prospects for China, a major consumer of copper.

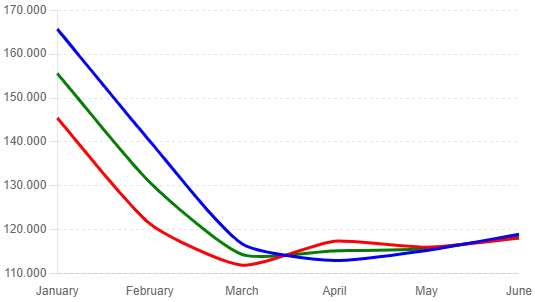

Copper Stock in LME Warehouses

In the LME warehouses this year, a declining trend in copper stock is noticeable. A decrease in stock can indicate higher demand or reduced supply, which often leads to rising prices. When comparing the stock trend of the first half of the year with the development of the copper price, we see that they are fairly aligned. It is interesting to monitor whether the current price drop will also lead to an increase in copper stocks in the LME warehouses. There has been a rising stock from May/June onwards

Long-Term Factors for Copper Price

Forecasts for the long-term copper price show an upward trend, primarily driven by increasing demand from sectors involved in the energy transition. Various sources predict that the demand for copper will increase by more than 50% by 2040, while production will only increase by about 16% (InvestorPlace) (S&P Global).

The long-term copper price forecasts are optimistic due to the growing demand, primarily driven by sectors involved in the energy transition. McKinsey, for example, predicts that the demand for copper for power generation, electric vehicles (EVs), and electronic devices by 2031 will lead to a copper shortage of 6.5 million tons (Nasdaq) (InvestorPlace).

Key Influencing Factors

- Energy Transition

Electric Vehicles (EVs) use between 38.5 and 83 kilograms of copper per vehicle. As more countries ban the sale of combustion engine vehicles, the demand for copper for EVs will significantly increase (Nasdaq) (InvestorPlace) - Renewable Energy

Solar and wind energy installations require large amounts of copper. For example, solar installations need about 5.5 tons of copper per megawatt, and offshore wind turbines even require 9.56 tons of copper per megawatt (Nasdaq).

Supply Issues

Major mine closures such as that of the Cobre Panama mine and production constraints at other mines have led to a tight supply. Analysts predict that these types of issues will push the market further into a deficit position by the end of 2024 (Nasdaq) (S&P Global).

Although some new projects are planned, such as the Quebrada Blanca phase 2 in Chile, they are not sufficient to fully fill the supply gap (Nasdaq).

Geopolitical and Economic Influences

Actions by central banks, such as interest rate hikes by the Federal Reserve, have a direct impact on the copper price. For example, a weaker dollar can lead to higher copper prices (InvestorPlace). Political stability and favorable regulations in copper-producing countries are crucial for attracting investments in new mining projects. Instability in regions such as the Democratic Republic of Congo can further disrupt the supply (Nasdaq).

Key Influencing Factors

Renewable energy sources such as solar and wind energy require large amounts of copper. For example, solar installations need about 5.5 tons of copper per megawatt, while offshore wind turbines even require 9.56 tons of copper per megawatt (Nasdaq).

The metal recycling sector faces a promising future, driven by technological innovations, sustainable production practices, and a growing demand for recycled metals. Companies active in this sector, such as Krommenhoek Metals, have the opportunity to play a crucial role in the transition to a circular economy. By investing in advanced technologies and sustainable practices, they can not only optimize their operations but also contribute to a more environmentally friendly future.

Read in our impact report how we, and scrap in general, contribute to a more sustainable and impactful future.

Terug